Borrowing and repaying in multi-currency and portfolio margin account modes

In multi-currency cross margin mode, your customized collateral cryptocurrencies are converted into their USD-equivalent value as margin for orders and positions.

In portfolio margin cross-margin mode, your assets in different cryptocurrencies are converted into their USD-equivalent value as margin for orders and positions.

You can turn on or off the auto-borrow function in both multi-currency and portfolio margin modes. Regardless of whether the auto-borrow function is turned on or off, the liability incurred from the unrealized loss of expiry futures, perpetual futures cross-margin positions won’t incur interest as long as it’s within the interest-free quota. If the liability exceeds the interest-free quota, the excess amount will incur interest.

Turning on or off auto-borrow

When auto-borrow is turned on, the liability incurred from a negative balance will be charged interest hourly. The liability incurred from the unrealized loss of expiry futures and perpetual futures cross-margin positions enjoy interest-free benefits. If it exceeds the interest-free quota, the excess amount will incur interest hourly. Besides, you can still trade spot margin.

When auto-borrow is turned off, the aggregate liability incurred from (i) negative balance, (ii) unrealized loss of expiry futures and perpetual futures cross-margin positions will enjoy interest-free benefits. If the aggregate liability exceeds the interest-free quota, forced repayment will be triggered. Note that forced repayment means the system will sell your other cryptocurrencies to repay the liability. Additionally, you can’t trade spot margin, futures, or options when your crypto’s available equity is less than the trading fee needed.

Liability

Term | Definition | Formula |

|---|---|---|

Cross-margin crypto liability | The amount of a crypto incurred when cross-margin equity is less than zero. | Abs {Min [0, Equity (cross)]} |

Liability is incurred when the crypto’s equity in the cross-margin account is less than zero. Below are some examples:

Scenario | Explanation | Calculation example |

|---|---|---|

Spot margin order filled | In spot margin trading, if the equity of a crypto is insufficient to cover the sell amount of a filled order, liability will incur. | Assume your account has 100,000 USDC, and you place a spot margin order to sell 1 BTC. After the order is filled, 1 BTC is deducted from your balance as the sold amount. Your BTC equity becomes –1 BTC, and a liability of 1 BTC is incurred. |

Trading fee for futures and options trading | In expiry futures, perpetual futures, and options trading, if the equity of a crypto is insufficient to cover the trading fee when the order is filled, liability will incur. | Assume your account has 10,000 USDC, and you place a BTC-USDT perpetual contract cross-margin order with a value of 10,000 USD. After the order is filled, 2 USDT is deducted from your balance as the trading fee. Your USDT equity becomes –2 USDT, and liability of 2 USDT is incurred. |

Isolated margin order filled | In isolated margin trading, if the equity of a crypto is insufficient to cover the margin and the trading fee required when an expiry futures, perpetual futures, or option order is filled, liability will incur. | Assume your account has 10,000 USDC and uses 10x leverage for an isolated BTC-USDT perpetual futures trade. You place an opening order valued at 1,000 USD. After the order is filled, 100 USDT in the cross-margin account is transferred to isolated-margin position and 0.2 USDT is deducted as the trading fee. Your USDT equity becomes –100.2 USDT, and liability of 100.2 USDT is incurred. |

Placing a buy order to close option position | When placing a buy order to close a short option position, if the equity of a crypto is insufficient to cover the premium required for closing the position when the order is filled, liability will incur. | Assume your account has 10,000 USDT and you place a BTC-USD option buy order to close the short position. After the order is filled, 0.02 BTC is deducted from your balance as the premium. Your BTC equity becomes –0.02 BTC, and liability of 0.02 BTC is incurred. |

Unrealized losses in expiry and perpetual futures trading | Due to changes in the mark price, if losses are incurred in expiry or perpetual futures positions and result in insufficient equity, liability will incur. Liability exceeding the interest-free quota will incur interest. For details about the interest-free quota, refer to the documentation below. | Assume your account has 10,000 USDC and holds a BTC-USDT perpetual futures position. If the unrealized loss for the position is –100 USDT, your USDT equity will be –100 USDT, and a liability of 100 USDT will be incurred. |

Option position market value | Due to changes in mark price, if a decrease in the market value of option positions results in losses and insufficient equity, liability will occur. Liability exceeding the interest-free quota will incur interest. For details about the interest-free quota, refer to the documentation below. | Assume your account has 10,000 USDT and 1 BTC, along with a short BTC-USD option position of 1 contract. If the market value of your position drops to –1.1 BTC, your BTC equity will be –0.1 BTC, and a liability of 0.1 BTC will be incurred. |

Funding fee for perpetual futures | In perpetual futures, if the equity of a crypto is insufficient to cover the funding fee when it is collected, liability will incur. | Assume your account has 10,000 USDC and a BTC-USDT perpetual contract cross-margin position. When the funding fee is collected, 10 USDT is deducted from your balance. Your USDT equity becomes –10 USDT and liability of 10 USDT is incurred. |

Interest-free quota

OKX offers interest-free benefits for the following liability scenarios:

When auto-borrow is turned on, the liability incurred from the unrealized loss of expiry futures and perpetual futures cross-margin positions enjoy interest-free benefits. If it exceeds the interest-free quota, the excess amount will incur interest hourly. Besides, you can still trade spot margin.

When auto-borrow is turned off, the liability incurred from negative balance, unrealized loss of expiry futures and perpetual futures cross-margin positions enjoy interest-free benefits. If it exceeds the interest-free quota, forced repayment will be triggered. Note that forced repayment means the system will sell your other cryptocurrencies to repay the liability. Additionally, you can’t trade spot margin, futures, or options when your crypto’s available equity is less than the trading fee needed.

Interest won’t be charged for liability within the interest-free quota. However, liability exceeding the interest-free quota will incur interest.

Crypto | Interest-free quota (crypto amount) |

|---|---|

USDT | 20,000 USDT + USDC equity available in your cross-margin account |

USDC | 5,000 |

BTC | 1 |

LTC | 10 |

ETH | 5 |

ETC | 2,000 |

XRP | 5,000 |

EOS | 500 |

BCH | 5 |

BSV | 5 |

TRX | 30,000 |

LINK | 50 |

DOT | 50 |

ADA | 500 |

ALGO | 500 |

ATOM | 20 |

CRV | 100 |

FIL | 10 |

DASH | 2 |

IOST | 10,000 |

IOTA | 500 |

KNC | 200 |

NEO | 10 |

ONT | 300 |

QTUM | 100 |

THETA | 100 |

SUSHI | 30 |

SUN | 20 |

XLM | 1,000 |

UNI | 20 |

XMR | 2 |

XTZ | 100 |

ZEC | 2 |

YFI | 0.01 |

YFII | 0.1 |

For more details, refer to the product documentation on interest calculation.

Interest calculation and deduction

OKX records your liability in the cross-margin account and charges interest at the start of every hour. Corresponding bills are generated at the same time. Interest is charged on the corresponding liability crypto’s balance, and the interest deduction process will be completed within 3 minutes.

Interest calculation:

Interest = Liability exceeding the interest-free quota × (Annualized interest rate / 365 / 24)

Liability exceeding the interest-free quota and annualized interest rate are both recorded at the start of every hour. Note that liability exceeding the interest-free quota incurred in the first minute of the start of every hour might be recorded as well.

Example: If you have a liability incurred at 22:50, no interest will be deducted at this time. At 23:00, your interest will be calculated based on the amount of liability at this time. At 23:01, interest will be deducted, the corresponding bill is generated, and the crypto’s balance changes. So, if you repay the liability at 22:57, your liability won’t incur interest.

Potential borrowing and borrowing quota

Term | Definition | Formula |

|---|---|---|

Potential borrowing of crypto | Includes the liability of a crypto and the liability that might incur after the spot sell orders and isolated margin orders are filled. Potential borrowing requires you to have the corresponding margin, known as potential borrowing or borrowing leverage. | Abs {Min [0, crypto equity (cross) – Frozen equity]} |

Potential borrowing is incurred when the crypto’s equity is less than the frozen equity in the cross-margin account. Potential borrowing margin is required when potential borrowing is incurred. Potential borrowing takes up the borrowing quota.

Scenario | Explanation | Calculation example |

|---|---|---|

Frozen in spot margin order | In spot margin trading, if the equity of a crypto is insufficient to cover the sell quantity of the spot margin order, potential borrowing will incur. | Assume your account has 50,000 USDT, 1 BTC, and you place a spot margin order to sell 1.2 BTC. After the order is placed, 1.2 BTC is frozen in your balance. As a result, 0.2 BTC of potential borrowing is incurred, and 0.2 BTC of the borrowing quota is occupied. If that order is canceled, the corresponding potential borrowing will also be canceled, and the borrowing quota is released. |

Frozen in estimated trading fee for futures and options trading | In expiry futures, perpetual futures, and options trading, if the equity of a crypto is insufficient to cover the estimated trading fee when the order is placed, potential borrowing will incur. | Assume your account has 10,000 USDC, and you place a BTC-USDT perpetual contract cross-margin order with a value of 10,000 USD. After the order is placed, 2 USDT is frozen in your balance as the estimated trading fee. As a result, 2 USDT of potential borrowing is incurred, and 2 USDT of the borrowing quota is occupied. If that order is canceled, the corresponding potential borrowing will also be canceled, and the borrowing quota is released. |

Frozen in isolated margin order | In isolated margin trading, if the equity of a crypto is insufficient to cover the margin and trading fees required for a expiry futures, perpetual futures, or option order when it is placed, potential borrowing will incur. | Assume your account has 10,000 USDC and uses 10x leverage for an isolated BTC-USDT perpetual futures trade. You place an open order valued at 1,000 USD. After the order is placed, 100 USDT in the cross-margin account is frozen from your balance and 0.2 USDT is frozen as the trading fee. As a result, 100.2 USDT is incurred, and 100.2 USDT of the borrowing quota is occupied. If that order is canceled, the corresponding potential borrowing will also be canceled, and the borrowing quota is released. |

Frozen in option buy order for closing a position | When placing a buy order to close a short option position, if the equity of a crypto is insufficient to cover the premium required for closing the position when the order is placed, potential borrowing will incur. | Assume your account has 10,000 USDT and you place a BTC-USD option buy order to close the short position. After the order is placed, 0.02 BTC is frozen from your balance as the premium. As a result, 0.02 BTC of the borrowing quota is occupied. If that order is canceled, the corresponding potential borrowing will also be canceled, and the borrowing quota is released. |

Unrealized losses in expiry and perpetual futures trading | If mark price changes and losses are incurred in expiry or perpetual futures positions, making equity less than zero, potential borrowing will occur. | Assume your account has 10,000 USDC and holds a BTC-USDT perpetual futures position. If the unrealized loss for the position is –100 USDT, your USDT equity will be –100 USDT. Potential borrowing of 100 USDT will be incurred. |

Option position market value | If mark price changes and a decrease in the market value of option positions results in losses, and equity is less than zero, potential borrowing will occur. | Assume your account has 10,000 USDT and 1 BTC, along with a 1 BTC-USD option short position. If the market value of your position drops to –1.1 BTC, your BTC equity will be –0.1 BTC. Potential borrowing of 0.1 BTC will be incurred. |

Funding fee for perpetual futures | In perpetual futures, if the equity of a crypto is insufficient to cover the funding fee when it is collected, potential borrowing will incur. | Assume your account has 10,000 USDC and a BTC-USDT perpetual contract cross-margin position. When the funding fee is collected, 10 USDT is deducted from your balance. Your USDT equity becomes –10 USDT and liability of 10 USDT is incurred. |

Margin crypto position tier limit

OKX limits your maximum borrowing amount when a higher leverage is selected. This means the higher the leverage, the lower the borrowing cap for your leveraged position. Therefore, if you have significant available funds but select a high leverage, the maximum order amount may be smaller than your available funds.In such cases, you can consider lowering the leverage to gain greater purchasing power.

For details, refer to position tiers.

Main account borrowing quota

All users are subject to a maximum borrowing quota at the main account level. The borrowing quota varies based on the crypto borrowed and your VIP level. For example, if you’re VIP 5 and the main account USDT borrowing limit is 35,000,000 USDT, the total USDT borrowing amount across your main account and all sub-accounts can’t exceed this limit.

To learn more about borrowing quotas for different VIP levels and cryptocurrencies, refer to market interest rate.

Platform borrowing quota

All borrowing on OKX is sourced from assets stored by users in the flexible savings product, Simple Earn. The total borrowing amount is limited by your total assets stored in Simple Earn.

To learn more, refer to Simple Earn rules.

Checking your borrowing data

Refer to borrowing data to check your borrowing data.

Borrowing history

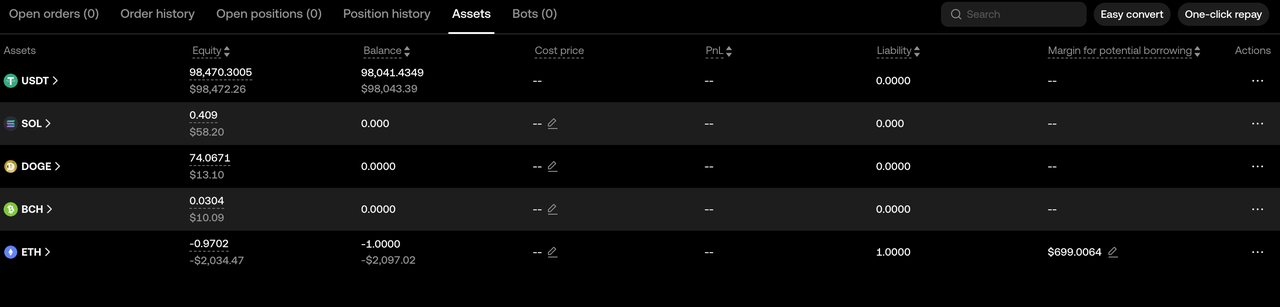

Assets tab

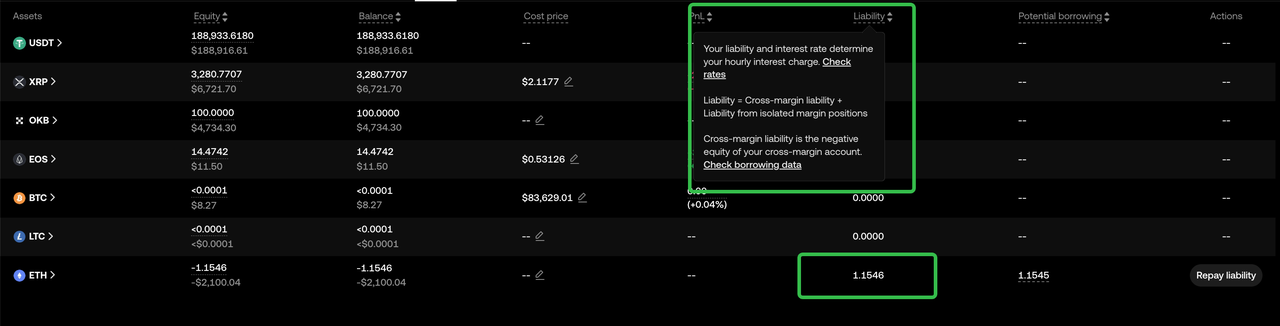

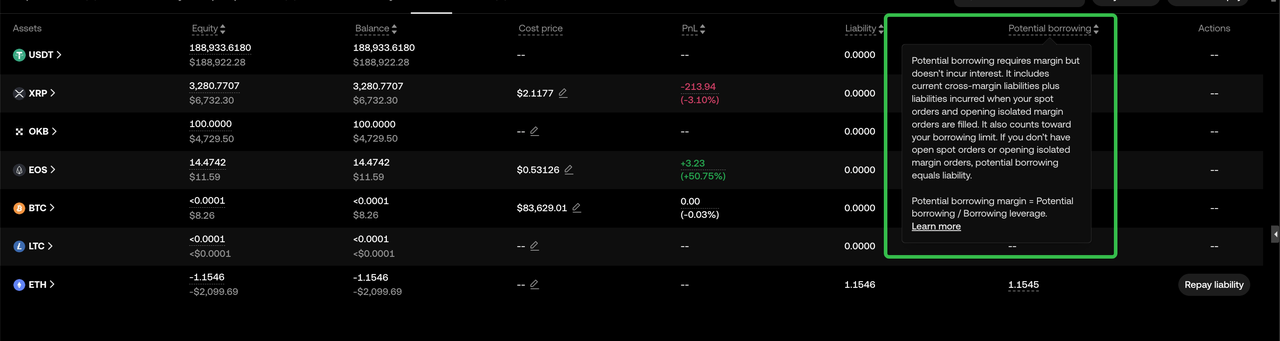

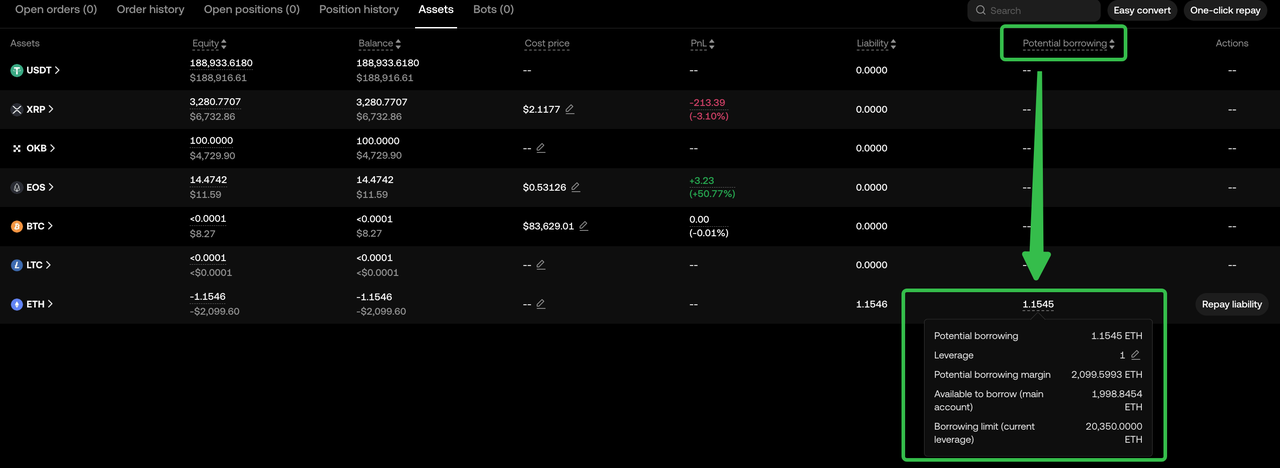

You can check the borrowed and potential borrowing amount for each crypto under the Assets tab on the Trading page. You can also select any potential borrowing value to check data such as borrowing leverage, potential borrowing margin, and borrowing limit.

For web:

For app:

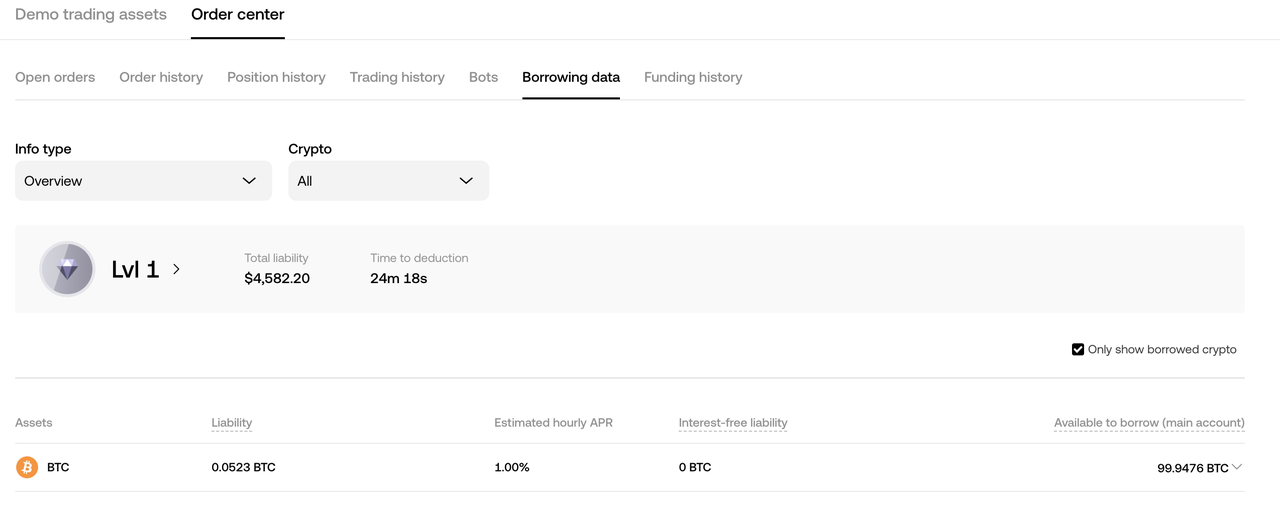

Borrowing data details: current borrowing overview

You can access this page by hovering over liability to open its tooltip under the Assets tab.

In multi-currency and portfolio margin accounts, you can check the following details by selecting overview in the info type dropdown: total liability for each crypto, estimated annualized hourly APR, interest-free liability, and available to borrow (main account), and main account borrowing limit.

Interest-free borrowing amount:

Borrowing within the interest-free quota from unrealized losses in expiry futures and perpetual futures doesn’t incur interest.

Main account available borrowing amount:

This is shared between the trading account and Flexible Loan.

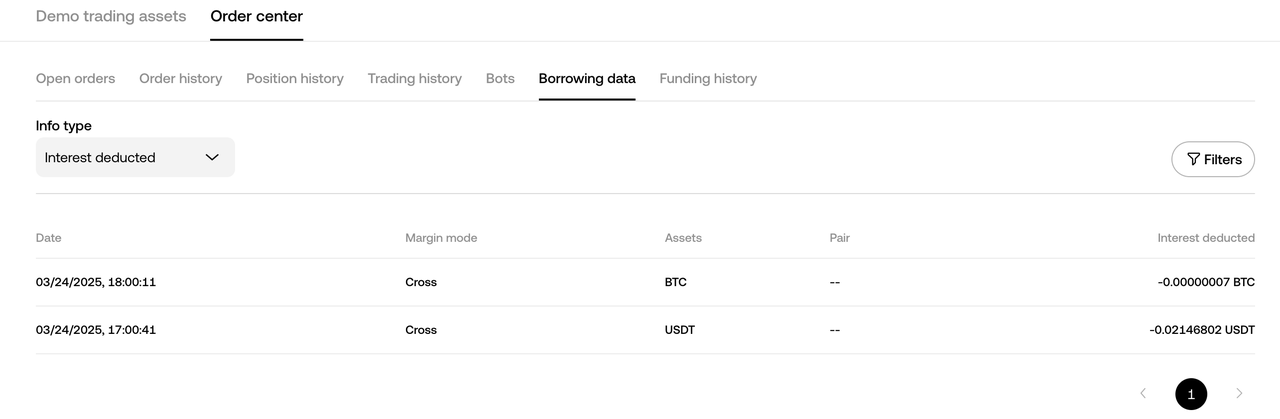

Borrowing data details: interest deduction records

Select interest deducted in the info type dropdown to access the hourly interest deduction logs. Here, you can find the following information: interest deduction date, margin mode, assets, pair, and interest deducted.

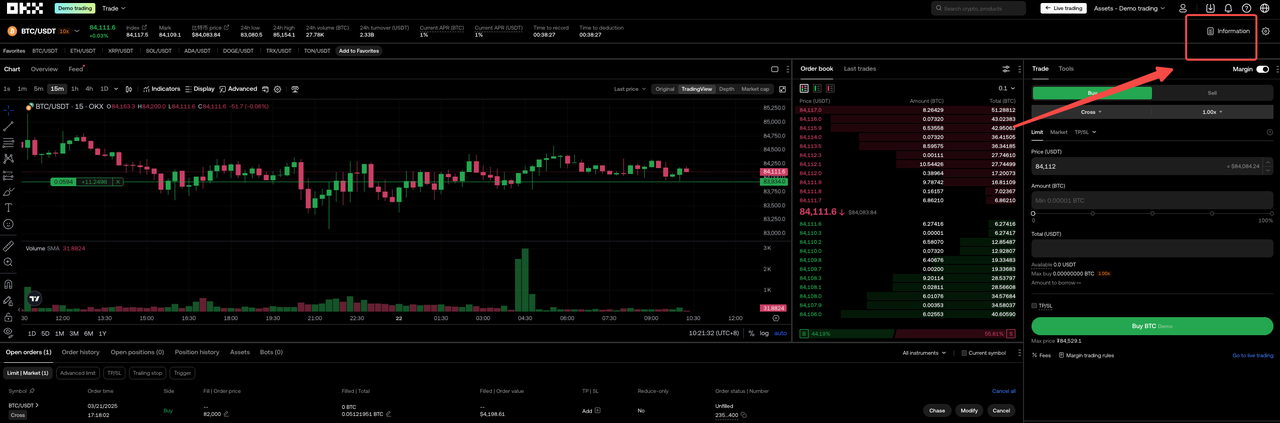

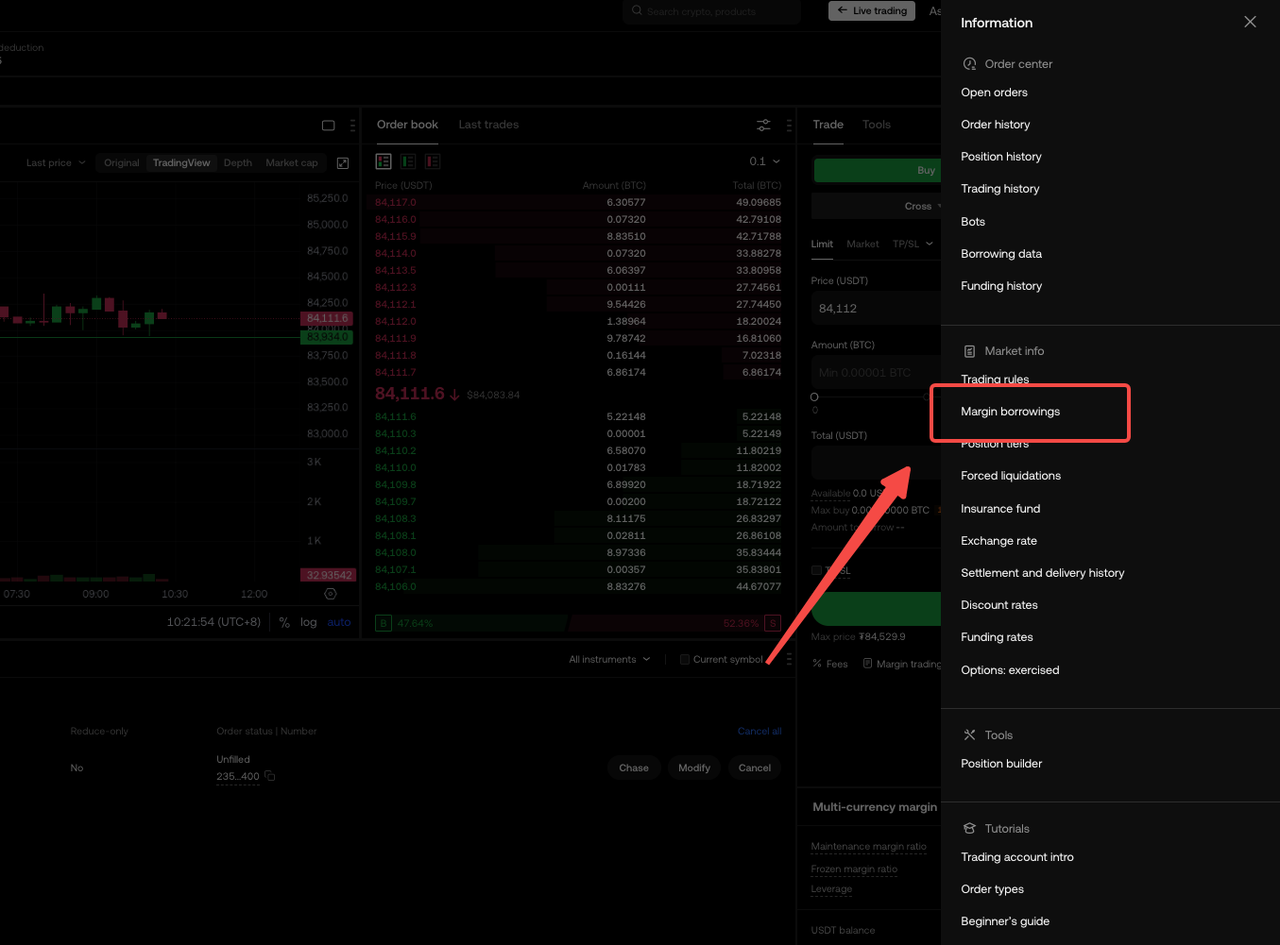

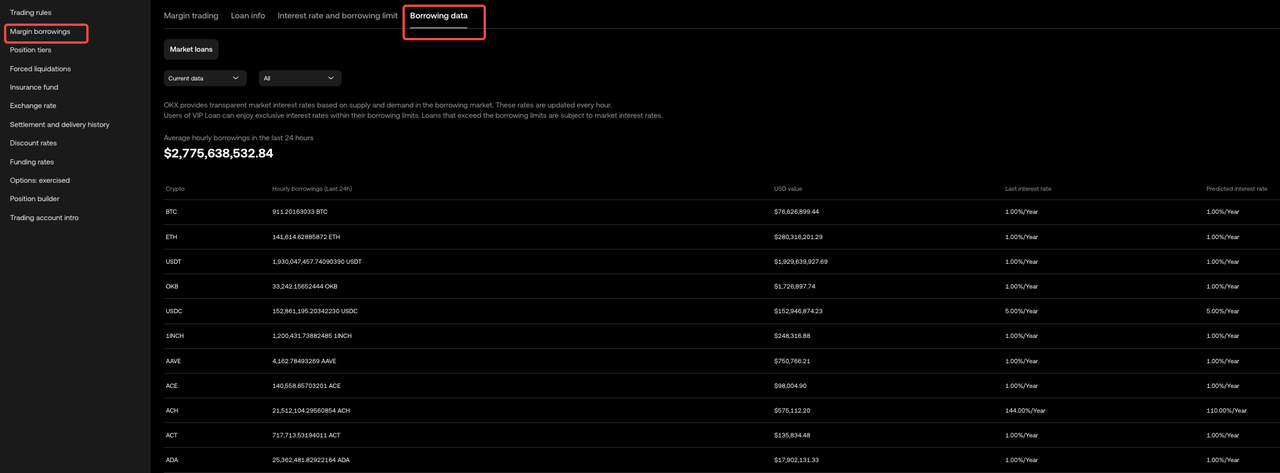

Market borrowing information

On the Trading page, go to information and select margin borrowings. Here, you can check details such as the total borrowing amount for each crypto on the OKX platform, the interest rate for the previous hour, and the estimated interest rate for the next hour.

Repaying liability

You can repay liability using one of the following 3 ways:

1. Spot trading

You can place a spot order, and the system will automatically repay the liability amount for you.

Example: If you have liability of 500 USDT in a cross-margin account, and you place a spot order to obtain 500 USDT, the system will automatically repay the liability of 500 USDT for you.

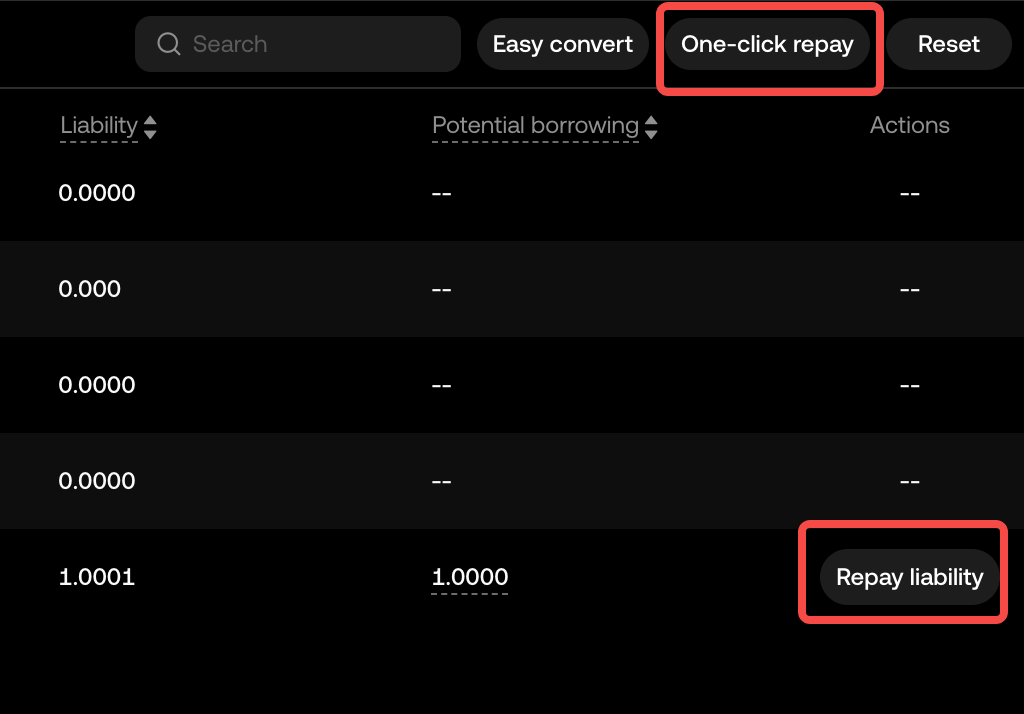

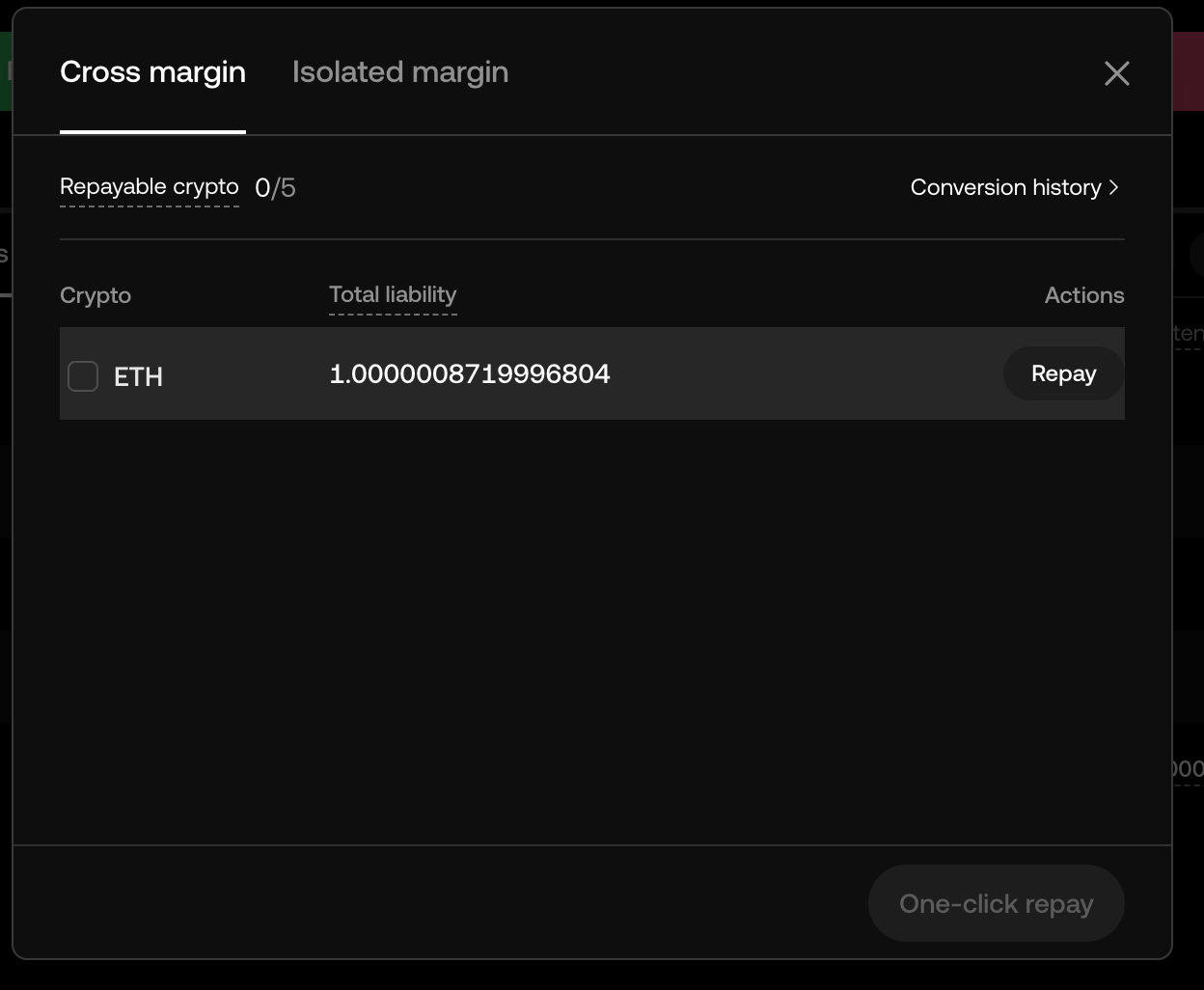

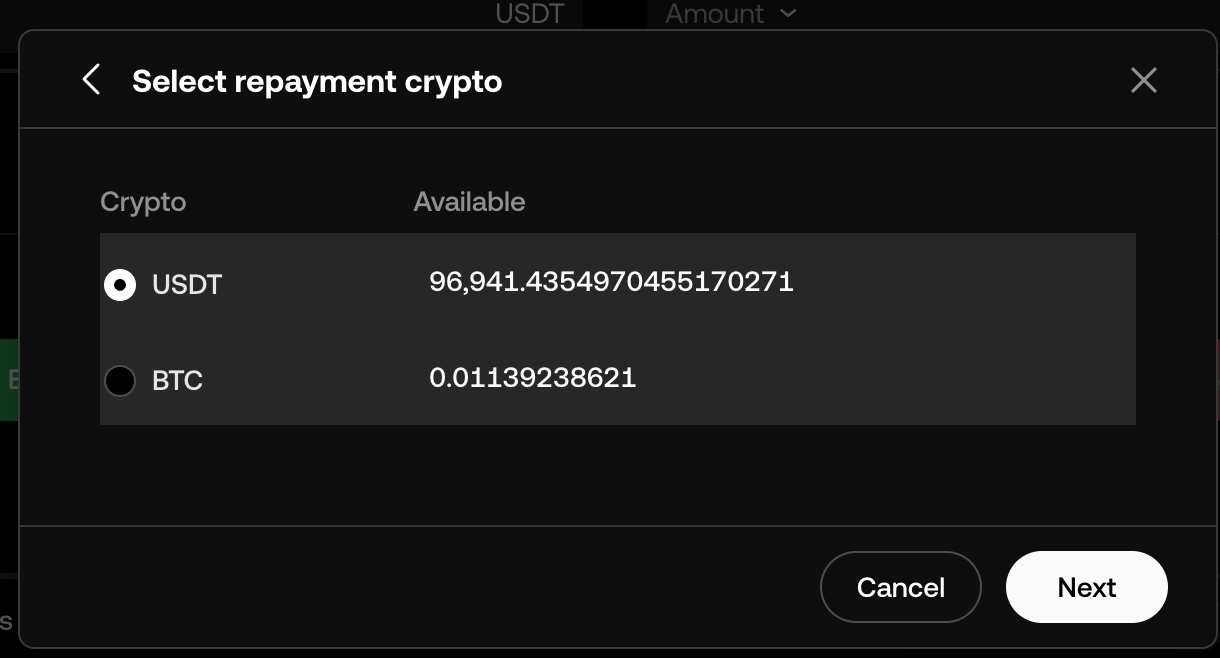

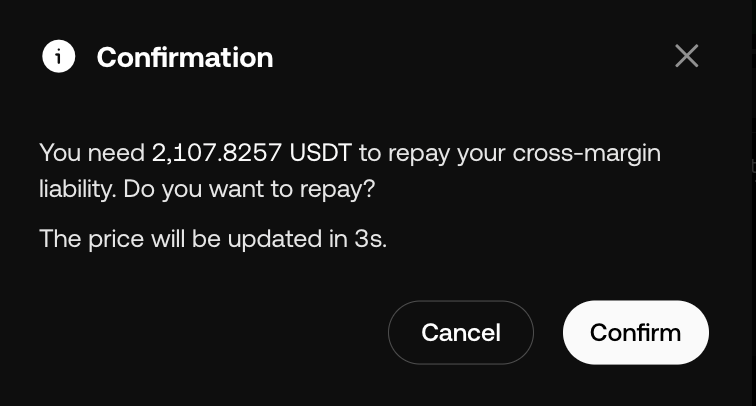

2. One-click repay

You can repay liability under the Asset tab on the Trading page.

Select one-click repay and choose the crypto you’re repaying liability for.

You can repay liability by selling the BTC, ETH, or USDT balance you have. Choose and confirm the crypto you wish to sell, and the system will then repay the liability automatically.

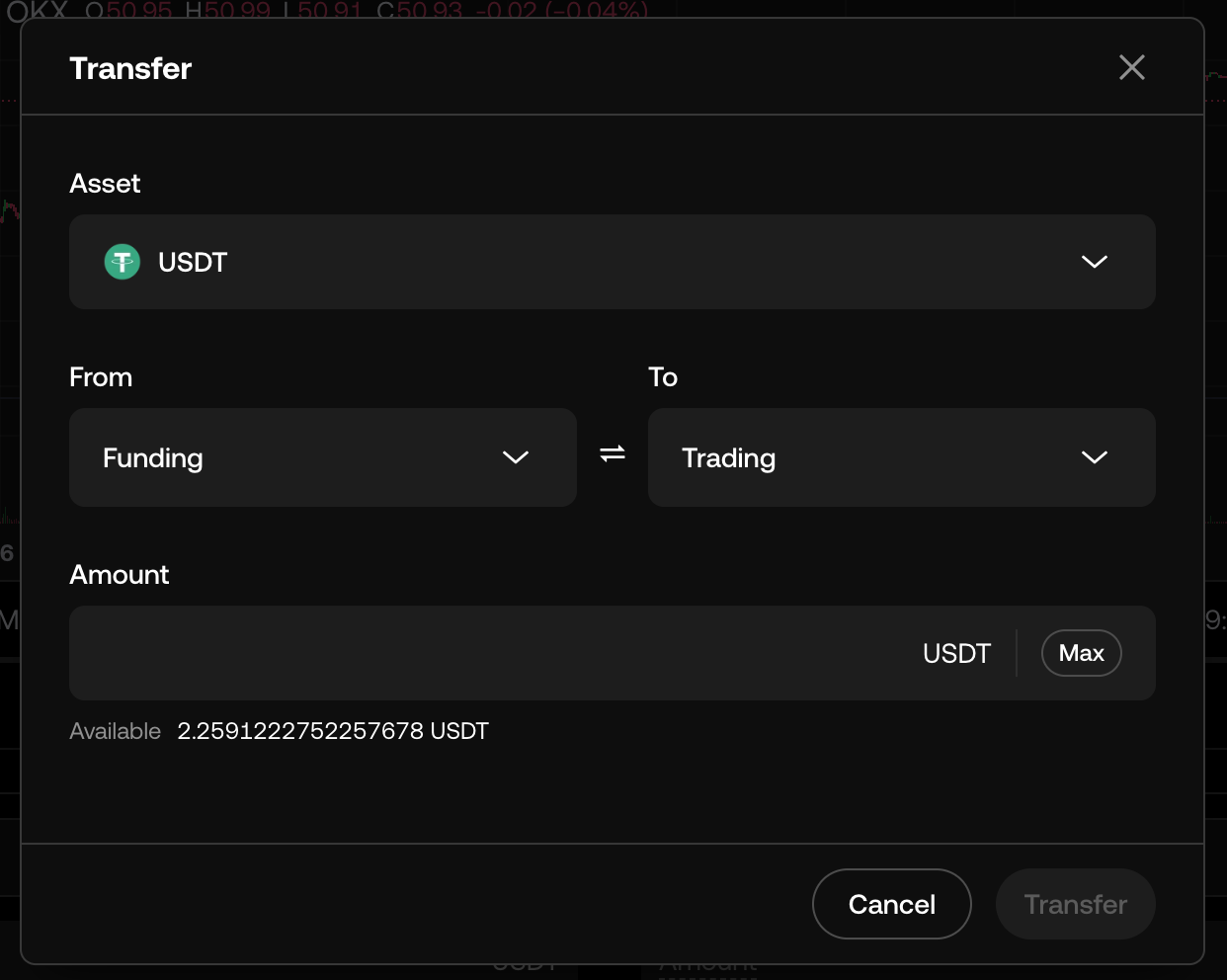

3. Transfer-In

Besides the two methods above, you can also repay liability by transferring the liability crypto from your funding to your trading account. The system will also repay the liability for you automatically.

This document is provided for informational purposes only. It is not intended to provide any investment, tax, or legal advice, nor should it be considered an offer to purchase, sell, hold or offer any services relating to digital assets. Digital asset holdings, including stablecoins, involve a high degree of risk, can fluctuate greatly, and can even become worthless. Leveraged trading in digital assets magnifies both potential gains and potential losses and could result in the loss of your entire investment. Past performance is not indicative of future results. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition, particularly if considering the use of leverage. You are solely responsible for your trading strategies and decisions, and OKX is not responsible for any potential losses. Not all products and promotions are available in all regions. For more details, please refer to the OKX Terms of Service and Risk & Compliance Disclosure.

© 2025 OKX. All rights reserved.