SONIC

Sonic SVM price

$0.28528

+$0.015640

(+5.80%)

Price change for the last 24 hours

How are you feeling about SONIC today?

Share your sentiments here by giving a thumbs up if you’re feeling bullish about the coin or a thumbs down if you’re feeling bearish.

Vote to view results

Sonic SVM market info

Market cap

Market cap is calculated by multiplying the circulating supply of a coin with its latest price.

Market cap = Circulating supply × Last price

Market cap = Circulating supply × Last price

Circulating supply

Total amount of a coin that is publicly available on the market.

Market cap ranking

A coin's ranking in terms of market cap value.

All-time high

Highest price a coin has reached in its trading history.

All-time low

Lowest price a coin has reached in its trading history.

Market cap

$103.10M

Circulating supply

360,000,000 SONIC

15.00% of

2,400,000,000 SONIC

Market cap ranking

167

Audits

CertiK

Last audit: --

24h high

$0.30316

24h low

$0.25938

All-time high

$1.3184

-78.37% (-$1.0332)

Last updated: 8 Jan 2025

All-time low

$0.020000

+1,326.39% (+$0.26528)

Last updated: 7 Jan 2025

Sonic SVM Feed

The following content is sourced from .

CoinDesk

By Francisco Rodrigues (All times ET unless indicated otherwise)

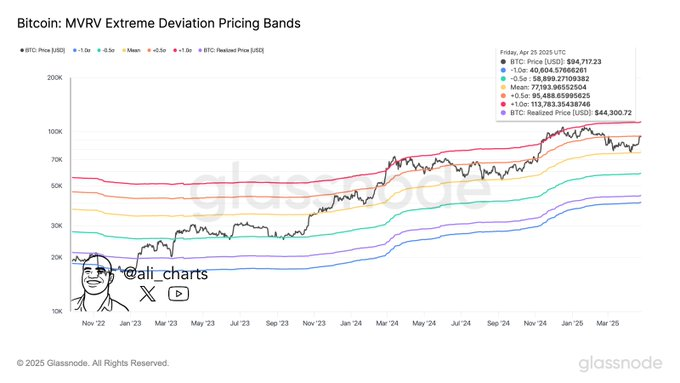

Cryptocurrencies fell slightly in the past 24 hours, with the broad market CoinDesk 20 (CD20) index dropping 1.4%. Bitcoin (BTC) is little changed around $95,000. These figures are well within recently volatility ranges and come on the back of a strong monthly performance — BTC is on track to rise 15% in April, the most since November.

The market has been grappling with growing pessimism surrounding the potential impact of President Donald Trump's reciprocal tariffs on nearly every country and optimism that the Federal Reserve will cut interest rates earlier than expected.

Stock prices have rallied over the past week on expectations Trump would lower the tariffs and the continuation of interest-rate cuts, according to Spanish bank Bankinter.

“Yet the perspective could turn for the worse from today, applying the logic of the data, because — regardless of tariffs and rate cuts — part of the damage has already been done, chiefly to confidence, which is the market’s foundation,” the bank wrote in a note.

Indeed, various major companies, including P&G, UPS, PepsiCo, American Airlines and GM, have lowered or pulled their earnings forecasts. Bankinter pointed out that French first-quarter GDP data released today showed a quarter-on-quarter increase that was entirely inventory-driven, while consumption, investment, and exports are weakening.

That bodes poorly for the U.S. figure, set to be released at 8:30 a.m. Some market observers, including Bankinter, suggest it could contract sharply. Bitcoin’s rise so far this year, contrasting with the stock market’s worst 100 days of a presidential administration since 1974, could be further evidence the cryptocurrency is starting to be used as a hedge.

As mentioned earlier in the week, Greg Cipolaro, the global head of research at NYDIG, wrote in a note that BTC has been acting “more like the non-sovereign issued store of value that it is.”

Bitcoin has decoupled from U.S. equities after the trade war between the U.S. and China escalated and has been seeing bets on it rise. This month, spot bitcoin ETFs posted monthly total net inflows of little over $3 billion according to SoSoValue data, further pointing to a flight to the cryptocurrency space amid the uncertainty. Stay alert!

What to Watch

Crypto:

April 30, 9:30 a.m.: ProShares will debut three ETFs that will provide leveraged and inverse exposure to XRP: the ProShares Ultra XRP ETF, the ProShares Short XRP ETF and the ProShares UltraShort XRP ETF.

April 30, 10:03 a.m.: Gnosis Chain (GNO), an Ethereum sister chain, will activate the Pectra hard fork on its mainnet at slot 21,405,696, epoch 1,337,856.

May 1: Coinbase Asset Management will introduce the Coinbase Bitcoin Yield Fund (CBYF), which is aimed at non-U.S. investors.

May 1: Hippo Protocol starts up its own layer-1 blockchain mainnet built on Cosmos SDK and completes a migration from Ethereum’s ERC-20 HPO token to its native HP token, enabling staking and governance.

May 1, 9 a.m.: Constellation Network (DAG) activates the Tessellation v3 upgrade on its mainnet, introducing delegated staking, node collateral, token locking and new transaction types to enhance network security, scalability and functionality.

May 1, 11 a.m.: THORChain activates its v3.5 mainnet upgrade, adding the TCY token to convert $200 million in debt into equity. TCY holders earn 10% of network revenue, while native RUNE remains the protocol’s security and governance token. TCY activates May 5.

May 5, 3 a.m.: IOTA’s Rebased network upgrade starts. Rebased moves IOTA to a new network, boosting capacity to as many as 50,000 transactions per second, offering staking rewards of 10%-15% a year and adding support for MoveVM smart contracts.

May 5, 10 a.m.: The Crescendo network upgrade goes live on the Kaspa (KAS) mainnet. This upgrade boosts the network’s performance by increasing the block production rate to 10 blocks per second from 1 block per second.

Macro

April 30, 8 a.m.: Brazil’s Institute of Geography and Statistics (IBGE) releases March unemployment rate data.

Unemployment Rate Est. 7% vs. Prev. 6.8%

April 30, 8 a.m.: Mexico's National Institute of Statistics and Geography releases (preliminary) Q1 GDP growth data.

GDP Growth Rate QoQ Prev. -0.6%

GDP Growth Rate YoY Prev. 0.5%

April 30, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases (advance) Q1 GDP growth data.

GDP Growth Rate QoQ Est. 0.4% vs. Prev. 2.4%

April 30, 10 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases March consumer income and expenditure data.

Core PCE Price Index MoM Est. 0.1% vs. Prev. 0.4%

Core PCE Price Index YoY Est. 2.6% vs. Prev. 2.8%

PCE Price Index MoM Est. 0% vs. Prev. 0.3%

PCE Price Index YoY Est. 2.2% vs. Prev. 2.5%

Personal Income MoM Est. 0.4% vs. Prev. 0.8%

Personal Spending MoM Est. 0.6% vs. Prev. 0.4%

May 1, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance data for the week ended April 26.

Initial Jobless Claims Est. 224K vs. Prev. 222K

May 1, 9:30 a.m.: S&P Global releases Canada April purchasing managers’ index (PMI) data.

Manufacturing PMI Prev. 46.3

May 1, 10:00 a.m.: Institute for Supply Management (ISM) releases U.S. April economic activity data.

Manufacturing PMI Est. 48 vs. Prev. 49

Earnings (Estimates based on FactSet data)

April 30: Robinhood Markets (HOOD), post-market, $0.33

May 1: Block (XYZ), post-market, $0.97

May 1: Reddit (RDDT), post-market, $0.02

May 1: Riot Platforms (RIOT), post-market, $-0.23

May 1: Strategy (MSTR), post-market, $-0.11

May 8: Coinbase Global (COIN), post-market, $2.08

May 8: Hut 8 (HUT), pre-market

May 8: MARA Holdings (MARA), post-market

Token Events

Governance votes & calls

Compound DAO is voting on moving 35,200 COMP ($1.5 million) into a multisig safe to test selling covered calls on COMP for USDC, lend that USDC in Compound for extra yield, then use the returns to buy back COMP and repeat — targeting a roughly 15 % annual gain. Voting ends May 2.

April 30, 12 p.m.: Helium to host a community call meeting.

May 5, 4 p.m.: Livepeer (LPT) to host a Treasury Talk session on Discord.

Unlocks

May 1: Sui (SUI) to unlock 2.28% of its circulating supply worth $261.2 million.

May 1: ZetaChain (ZETA) to unlock 5.67% of its circulating supply worth $12.31 million.

May 2: Ethena (ENA) to unlock 0.73% of its circulating supply worth $12.99 million.

May 7: Kaspa (KAS) to unlock 0.56% of its circulating supply worth $13.08 million.

May 9: Movement (MOVA) to unlock 2.04% of its circulating supply worth $12.31 million.

Token Launches

May 2: Binance to delist Alpaca Finance (ALPACA), PlayDapp (PDA), Viberate (VIB), and Wing Finance (WING).

May 5: Sonic (S) to be listed on Kraken.

Conferences

CoinDesk's Consensus is taking place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

Day 4 of 4: Web Summit Rio 2025

Day 1 of 2: TOKEN2049 (Dubai)

May 6-7: Financial Times Digital Assets Summit (London)

May 11-17: Canada Crypto Week (Toronto)

May 12-13: Dubai FinTech Summit

May 12-13: Filecoin (FIL) Developer Summit (Toronto)

May 12-13: Latest in DeFi Research (TLDR) Conference (New York)

May 12-14: ACI’s 9th Annual Legal, Regulatory, and Compliance Forum on Fintech & Emerging Payment Systems (New York)

May 13: Blockchain Futurist Conference (Toronto)

May 13: ETHWomen (Toronto)

Token Talk

By Shaurya Malwa

Solana-based Housecoin (HOUSE) zoomed to nearly $100 million market cap early Wednesday driven by a 24-hour price bump of 63% that brought its price to just under a cent.

HOUSE has surged more than 900% in the past three weeks, mainly on niche popularity in crypto circles and mentions from well-followed X accounts.

The trending memecoin is a satire on the real estate market, where prime locations are priced out for most of the general populace.

Holding HOUSE is, jokingly, considered by its cult to be holding actual property even though the token is intrinsically valueless and not backed by any real-world assets.

While its momentum and accessibility offer trading opportunities, its volatility, lack of clear fundamentals, and memecoin risks demand caution.

Derivatives Positioning

Among large-cap assets on Binance, PEPE and ADA hold negative funding APRs of -14.7% and -11.2%, respectively, according to Velo data. In contrast, TON, XLM, and XMR have seen funding APRs spike to 11%, highlighting a clear divergence in speculative positioning across major tokens.

In terms of open interest, BSW, DRIFT and PROMPT are among the top gainers, with daily open interest rising by 61%, 58%, and 33%, respectively — signaling idiosyncratic, intraday interest in these assets.

ALPACA, a BNB Chain asset, recorded over $55 million in short liquidations in the past 24 hours. That's the largest of any asset, according to CoinGlass data. The surge followed heavy short positioning after Binance’s delisting announcement a week ago, before a 550% price rally triggered widespread liquidations.

Market Movements

BTC is down 0.19% from 4 p.m. ET Tuesday at $94,915.28 (24hrs: unchanged)

ETH is down 0.57% at $1,805.20 (24hrs: -1.48%)

CoinDesk 20 is down 0.51% at 2,751.84 (24hrs: -1.27%)

Ether CESR Composite Staking Rate is up 19 bps at 2.99%

BTC funding rate is at 0.0008% (0.8377% annualized) on Binance

DXY is up 0.19% at 99.43

Gold is down 1.16% at $3,278.15/oz

Silver is down 1.64% at $32.36/oz

Nikkei 225 closed +0.57% at 36,045.38

Hang Seng closed +0.51% at 22,119.41

FTSE is up 0.13% at 8,474.22

Euro Stoxx 50 is up 0.24% at 5,174.41

DJIA closed on Tuesday +0.75% at 40,527.62

S&P 500 closed +0.56% at 5,560.83

Nasdaq closed +0.55% at 17,461.32

S&P/TSX Composite Index closed +0.31% at 24,874.48

S&P 40 Latin America closed unchanged at 2,548.27

U.S. 10-year Treasury rate is down 5 bps at 4.17%

E-mini S&P 500 futures are down 0.28% at 5,568.25

E-mini Nasdaq-100 futures are down 0.44% at 19,556.00

E-mini Dow Jones Industrial Average Index futures are down 0.22% at 40,596.00

Bitcoin Stats

BTC Dominance: 64.54 (0.16%)

Ethereum to bitcoin ratio: 0.01902 (-0.31%)

Hashrate (seven-day moving average): 837 EH/s

Hashprice (spot): $49.08

Total Fees: 6.17 BTC / $585,773.63

CME Futures Open Interest: 134,825 BTC

BTC priced in gold: 28.9 oz

BTC vs gold market cap: 8.19%

Technical Analysis

With bitcoin and most digital assets breaching key high-timeframe liquidity levels, a market pullback now appears likely.

Solana, along with many altcoins, has broken its weekly market structure with a strong upward move that swept liquidity at $153 before facing rejection at the 100-day exponential moving average (EMA) level.

Bulls will want the price action to print a higher low with the 100-day EMA on the weekly time frame sitting at $137, aligning with the weekly orderblock of demand.

Crypto Equities

Strategy (MSTR): closed at on Tuesday $381.45 (+3.3%), down 0.41% at $379.88 in pre-market

Coinbase Global (COIN): closed at $206.13 (+0.42%)

Galaxy Digital Holdings (GLXY): closed at $21.09 (-0.57%)

MARA Holdings (MARA): closed at $14.22 (+1.5%), down 0.28% at $14.18

Riot Platforms (RIOT): closed at $7.42 (-2.75%), down 0.40% at $7.39

Core Scientific (CORZ): closed at $8.29 (+0.61%), down 0.48% at $8.25

CleanSpark (CLSK): closed at $8.44 (-1.52%), down 0.24% at $8.42

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $14.19 (-0.98%)

Semler Scientific (SMLR): closed at $33.97 (-3.96%), up 4.95% at $35.65

Exodus Movement (EXOD): closed at $40.97 (-2.87%), up 2.49% at $41.99

ETF Flows

Spot BTC ETFs:

Daily net flow: $172.8 million

Cumulative net flows: $39.16 billion

Total BTC holdings ~ 1.15 million

Spot ETH ETFs

Daily net flow: $18.4 million

Cumulative net flows: $2.50 billion

Total ETH holdings ~ 3.44 million

Source: Farside Investors

Overnight Flows

Chart of the Day

Alpaca Finance (ALPACA) emerged as the top gainer on centralized exchanges with a price that's surged nearly 2,500% over the past seven days.

The rally is driven by a significant short squeeze, following heavy short positioning in the wake of Binance’s April 24 delisting announcement.

As a result, the token surged to a multiyear high of $1.375.

While You Were Sleeping

Telegram’s TON Takes On Real World Assets With Libre’s $500M Tokenized Bond Fund (CoinDesk): Libre plans to tokenize $500 million in Telegram debt as the Telegram Bond Fund (TBF) on the TON blockchain.

BlackRock Looking to Tokenize Shares of Its $150B Treasury Trust Fund, SEC Filing Shows (CoinDesk): The new "DLT" shares are expected to be bought and held through BNY, which plans to use blockchain technology to keep a mirror record of ownership for its clients.

SEC Delays Dogecoin and XRP ETF Decisions (CoinDesk): The SEC delayed decisions on the Bitwise DOGE ETF and the Franklin XRP Fund until June 15 and June 17, respectively.

Investors Turn to Emerging Market Debt After Trump Tariffs Hit U.S. Treasuries (CNBC): As confidence in Treasuries as a safe haven weakens, Mexico, Brazil and South Africa could see more bond demand, said Carol Lye, citing yield premiums and potential currency appreciation.

Chinese Investors Pile Into Gold Funds at Record Pace (Financial Times): China’s gold ETF holdings have doubled to 6% of the global total, with $7.4 billion in inflows this month accounting for more than half of global demand.

Asia Hedge Funds Add Japan, India After Tariff Shock, Says Morgan Stanley (Reuters): Funds increased exposure to Japanese tech, industrials and materials while retreating from Chinese consumer shares, as global investors expect Washington to strike trade deals with Tokyo and New Delhi.

In the Ether

Show original

31.07K

0

Sonic SVM price performance in USD

The current price of Sonic SVM is $0.28528. Over the last 24 hours, Sonic SVM has increased by +5.80%. It currently has a circulating supply of 360,000,000 SONIC and a maximum supply of 2,400,000,000 SONIC, giving it a fully diluted market cap of $103.10M. At present, the Sonic SVM coin holds the 167 position in market cap rankings. The Sonic SVM/USD price is updated in real-time.

Today

+$0.015640

+5.80%

7 days

+$0.023560

+9.00%

30 days

+$0.043360

+17.92%

3 months

-$0.17835

-38.47%

Popular Sonic SVM conversions

Last updated: 30/04/2025, 21:32

| 1 SONIC to USD | $0.28640 |

| 1 SONIC to SGD | $0.37409 |

| 1 SONIC to PHP | ₱15.9980 |

| 1 SONIC to EUR | €0.25180 |

| 1 SONIC to IDR | Rp 4,759.85 |

| 1 SONIC to GBP | £0.21443 |

| 1 SONIC to CAD | $0.39615 |

| 1 SONIC to AED | AED 1.0519 |

About Sonic SVM (SONIC)

The rating provided is an aggregated rating collected by OKX from the sources provided and is for informational purpose only. OKX does not guarantee the quality or accuracy of the ratings. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly, and can even become worthless. The price and performance of the digital assets are not guaranteed and may change without notice. Your digital assets are not covered by insurance against potential losses. Historical returns are not indicative of future returns. OKX does not guarantee any return, repayment of principal or interest. OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/ tax/ investment professional for questions about your specific circumstances.

Show more

- Official website

- White Paper

- Github

- Block explorer

About third-party websites

About third-party websites

By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates ("OKX") are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets.

Sonic SVM FAQ

How much is 1 Sonic SVM worth today?

Currently, one Sonic SVM is worth $0.28528. For answers and insight into Sonic SVM's price action, you're in the right place. Explore the latest Sonic SVM charts and trade responsibly with OKX.

What is cryptocurrency?

Cryptocurrencies, such as Sonic SVM, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

When was cryptocurrency invented?

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Sonic SVM have been created as well.

Will the price of Sonic SVM go up today?

Check out our Sonic SVM price prediction page to forecast future prices and determine your price targets.

Monitor crypto prices on an exchange

Watch this video to learn about what happens when you move your money to a crypto exchange.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.